car sales tax in fulton county ga

The 1 MOST does not apply to sales of motor vehicles. Customer Service Center at Maxwell Road 11575 Maxwell Road Alpharetta GA 30009.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Fulton County GA Sales Tax Rate.

. Kiosks will allow taxpayers to renew their vehicle registrations 24 hours a day 7 days a week. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. You can find these fees further down on the page.

Use Ad Valorem Tax Calculator. The current total local sales tax rate in Fulton County. Registration renewals at the kiosks have no additional charges for Fulton County residents.

TAVT is a one-time tax that is paid at the time the vehicle is titled. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. The Gwinnett County Georgia sales tax is 600 consisting of 400 Georgia state sales tax and 200 Gwinnett County local sales taxesThe local sales tax consists of a 200 county sales tax.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The Fulton County sales tax rate is. The local sales tax rate in fulton county is 3 and the maximum rate including georgia and city sales taxes is 89 as of january 2022.

There is also a local tax of between 2 and 3. To review the rules in Georgia visit our state-by-state guide. However this retail sales tax does not apply to cars that are bought in Georgia.

Georgia collects a 4 state sales tax rate on the purchase of all vehicles. On Tuesday August 2 City of Fulton residents have an opportunity to vote on continuing a vehicle sales tax on motor vehicles trailers boats and outboard motors purchased from outside the state of Missouri. The Georgia state sales tax rate is currently.

The tax must be paid at the time of sale by Georgia residents or within six months of. Instead of a Georgia state auto sales tax an Ad Valorem tax is. The Fulton County Sales Tax is 26.

This is the total of state and county sales tax rates. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. The Fulton County Sheriffs Office month of November 2019 tax sales.

A fifa acts as a lien against the property and is recorded on the countys real estate records. This is the total of state and county sales tax rates. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

For sales of motor vehicles that are subject to sales and use tax Georgia law provides for limited exemptions from certain local taxes. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. Has impacted many state nexus laws and sales tax collection requirements.

For TDDTTY or Georgia Relay Access. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. Any bidder who fails to pay will be banned from.

The City of Fulton has depended on the vehicle sales tax averaging between 40000 and 120000 each year to fund city projects. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. All taxes on the parcel in question must be paid in full prior to making a refund request.

Georgia collects a 4 state sales. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle.

Title Ad Valorem Tax TAVT became effective on March 1 2013. A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. The county-level sales tax rate in Fulton County is 3 and all sales in Fulton County are also subject to the 4 Georgia sales tax.

The kiosks are prominently located inside these high volume locations. Forsyth county ga sales tax rate. The 2018 United States Supreme Court decision in South Dakota v.

Gwinnett County collects a 2 local sales tax the maximum local sales tax. Cities towns and special districts within Fulton County collect additional local sales taxes with a maximum sales tax rate in Fulton County of 89. This calculator can estimate the tax due when you buy a vehicle.

Please fully complete this form. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. For example in Fulton County 2021 taxes were due by November 15 2021.

Please type the text you see in the image into the text box and submit. The minimum combined 2021 sales tax rate for fulton county georgia is. The Georgia state sales tax rate is currently.

This tax is based on the value of the vehicle. Calculating Georgia car tax isnt the most pleasant of tasks but knowing what youll pay before you purchase a car can take some of the shock away before you sign on the dotted line. Fulton County in Georgia has a tax rate of 775 for 2022 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Fulton County totaling 375.

In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees. When property taxes are not paid the countys taxing authority issues a fifa. According to CarsDirect Georgia has a state general sales tax rate of 4.

The state has a retail sales tax of 4 however this does not apply to motor vehicles purchased in the state. Property taxes in Georgia are due towards the end of the year. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner.

Get a Vehicle Out of Impound. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19.

GA 30303 404-612-4000 customerservicefultoncountygagov. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. The Gwinnett County Sales Tax is collected by the merchant on all qualifying sales made within Gwinnett County.

Taxpayer Refund Request Form. You can find more tax rates and allowances for Fulton County and Georgia in the 2022 Georgia Tax Tables. The Fulton County Sales Tax is 3.

Georgia Sales Tax Small Business Guide Truic

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

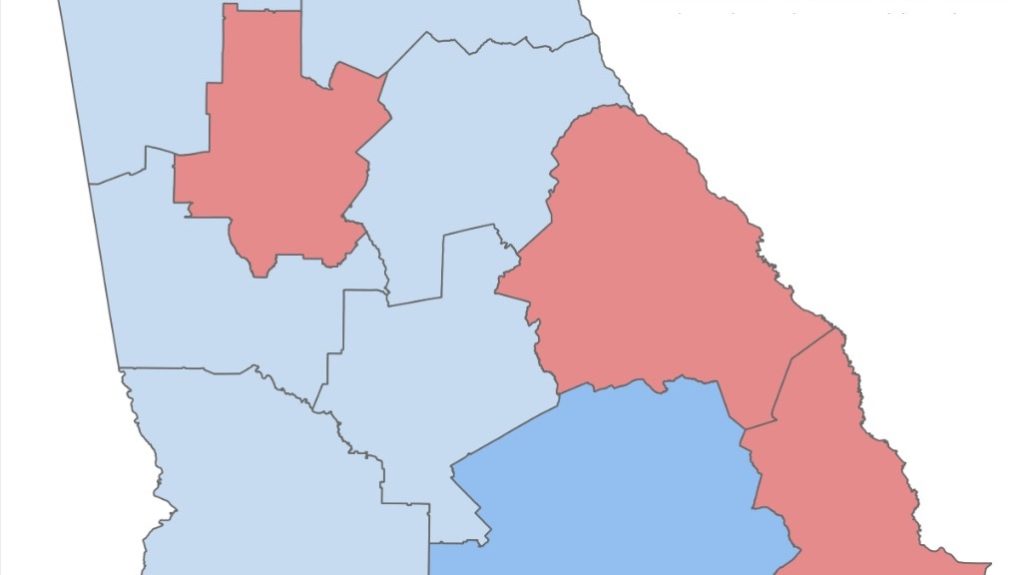

Oc Effective Sales Tax Rates In Georgia R Atlanta

How To Register For A Sales Tax Permit In Georgia Taxvalet

Georgia Sales Tax Rates And Compliance

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Georgia Sales Tax Exemptions Agile Consulting Group

Travel Documents For Trip Training Conferences Cobb County Georgia

Georgia Used Car Sales Tax Fees

Sales Taxes In The United States Wikiwand

![]()

Georgia New Car Sales Tax Calculator

Georgia Sales Tax Guide And Calculator 2022 Taxjar

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

How Georgia S Gas Tax Actually Works Georgia Taxpayers United

Georgia Sales Tax Rates By City County 2022