monterey county property tax rate

Yes you can pay your property taxes by using a DebitCredit card. 435 Main Rd PO.

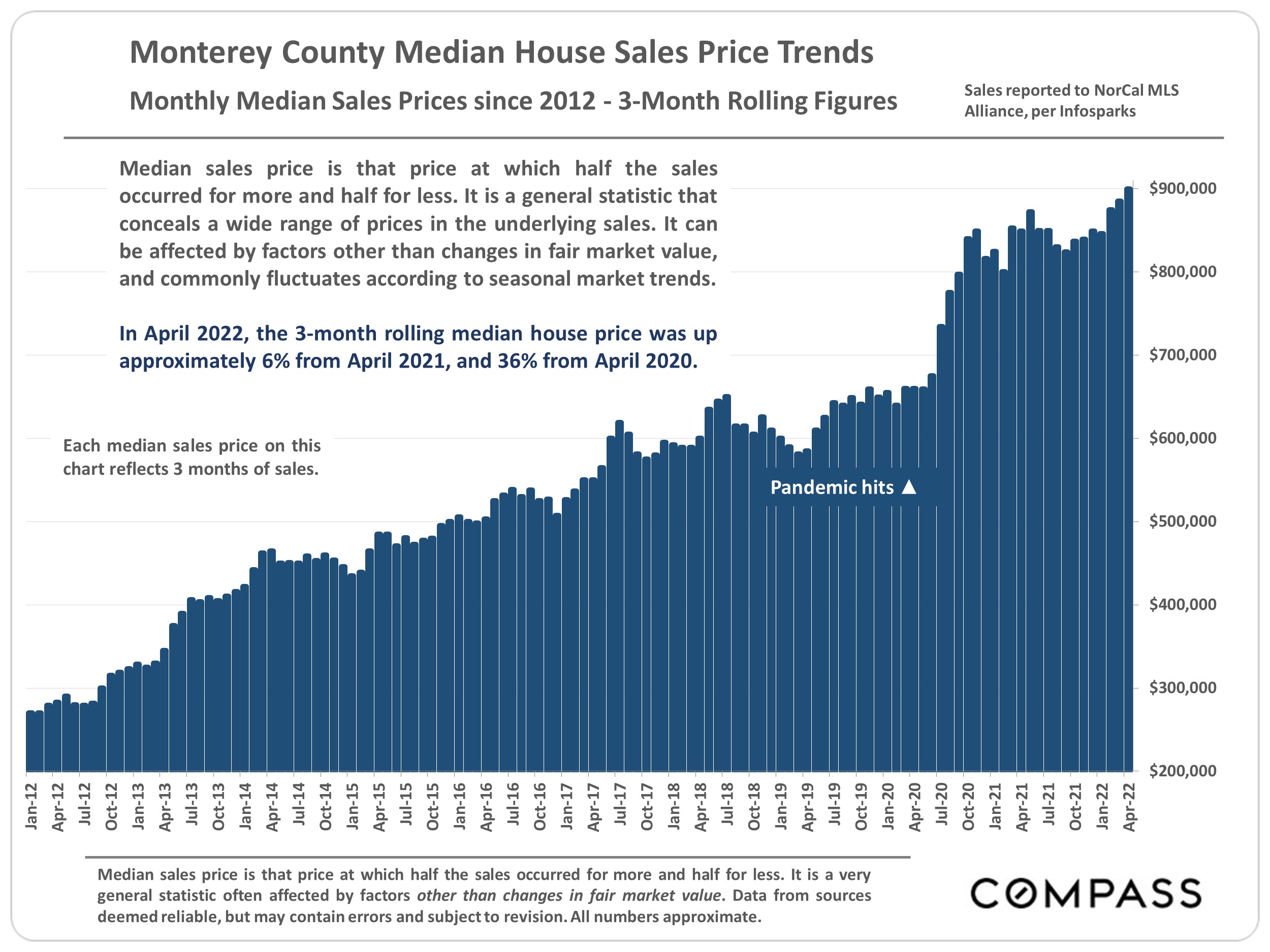

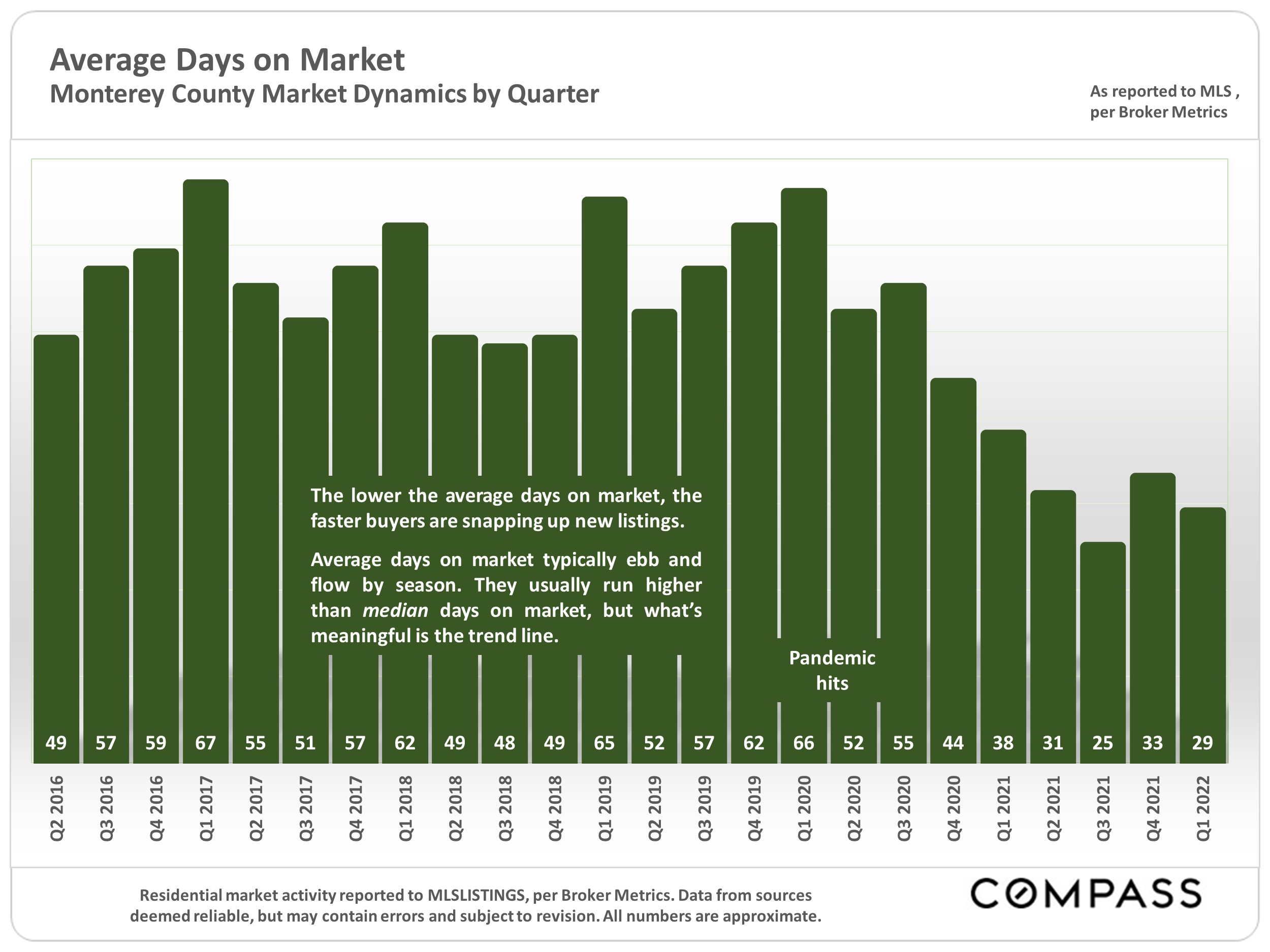

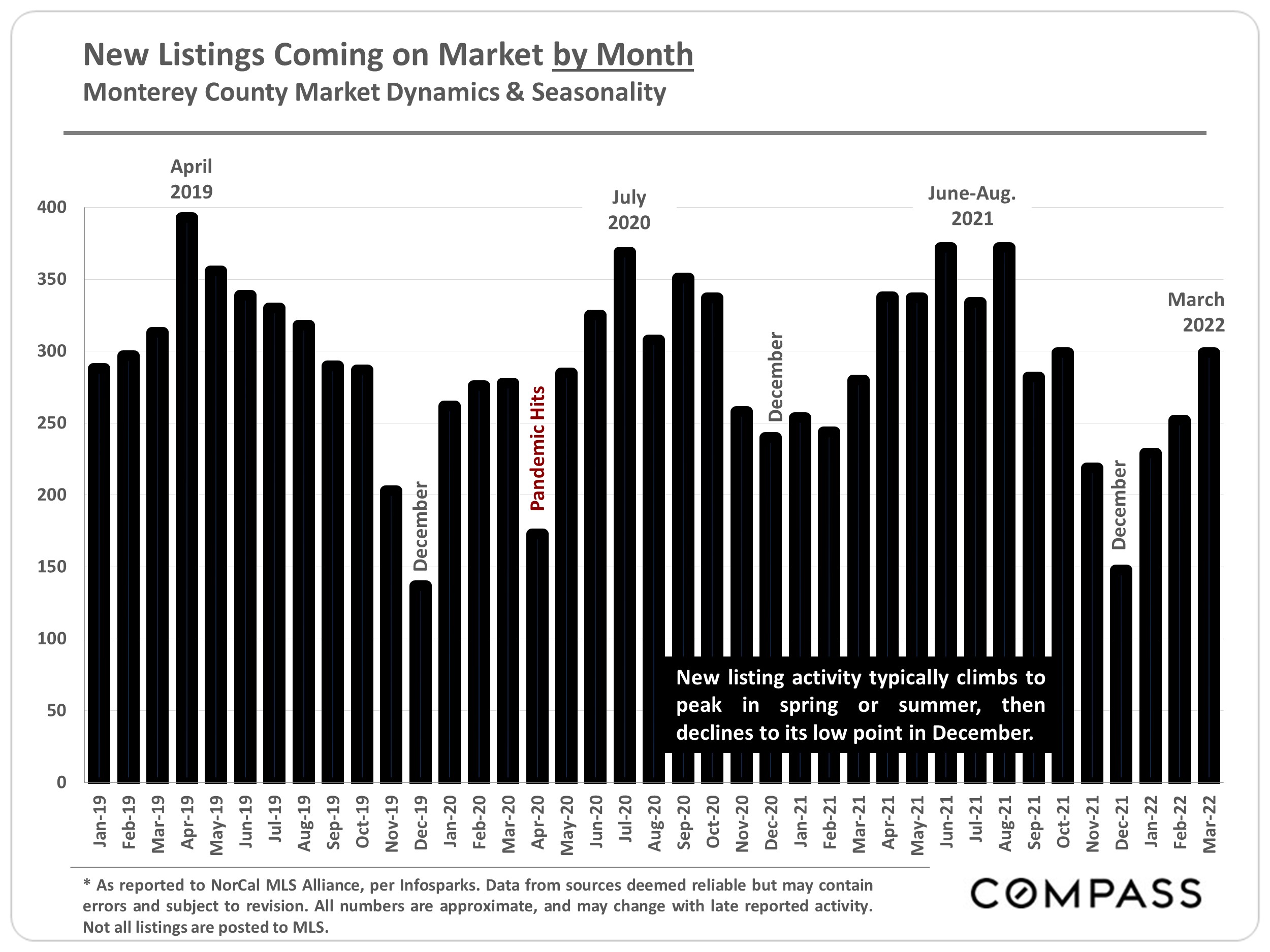

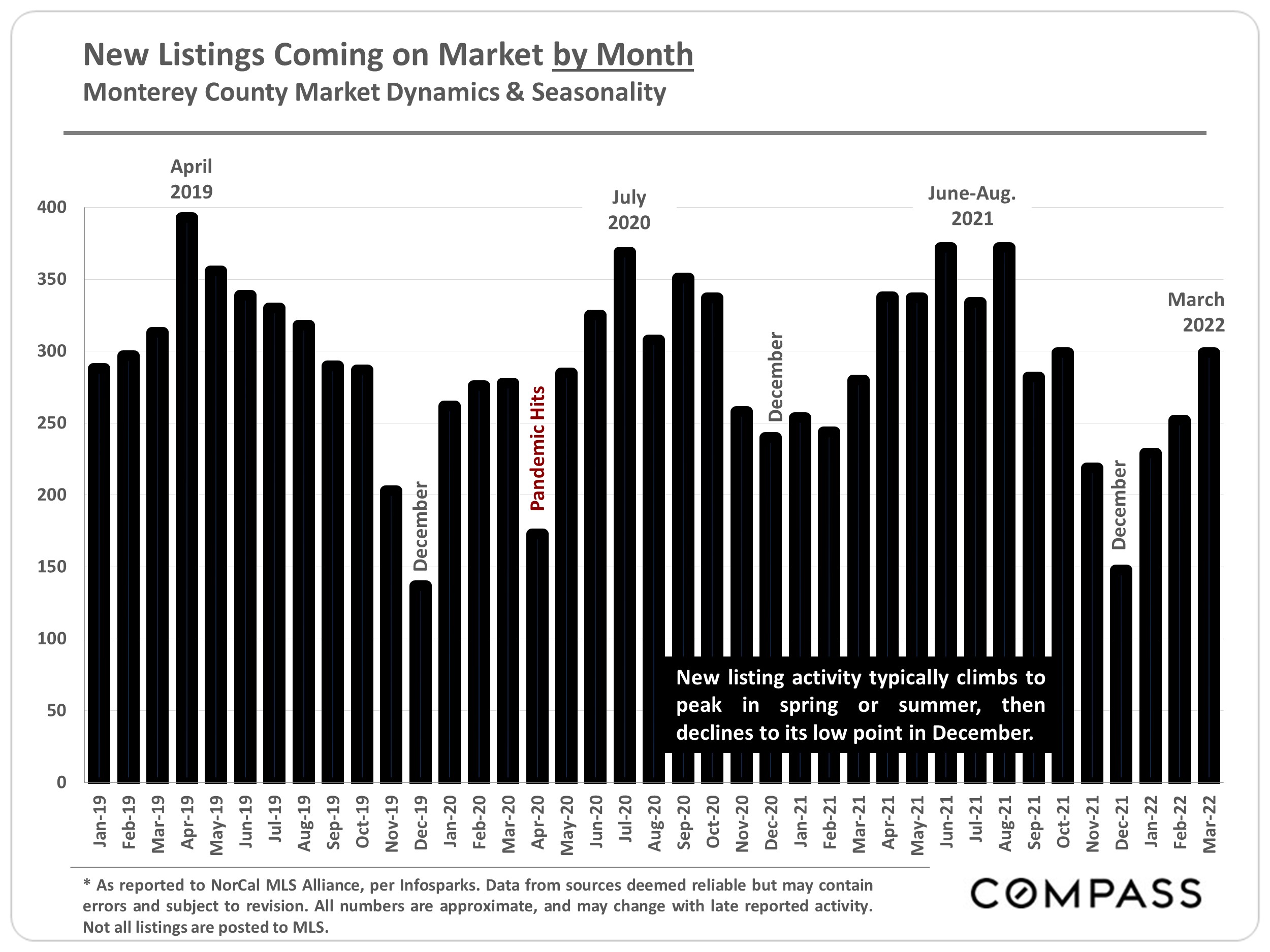

Monterey County Home Prices Market Trends Compass

Median Property Taxes No Mortgage 2461.

. Calculate the taxable units. The Monterey County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. 435 Main Rd PO.

Property Tax in Monterey County. For E-Check a flat fee of 025 is charged. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes finesfees banking and investment services.

District 3 - Chris Lopez. Monterey County Property Tax Payments Annual Monterey County California. The median property tax on a 56630000 house is 594615 in the United States.

Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Checks should be made payable to. Monterey County District Tax Sp 05.

For an easier overview of the difference in tax rates between counties explore the charts below. District 5 - Mary Adams. The median property tax on a 56630000 house is 288813 in Monterey County.

For credit cards the fee is 225 of the total amount you are paying. District 1 - Luis Alejo. Real estate ownership shifts from the seller to the new owner at closing.

All major cards MasterCard American Express Visa and Discover are accepted. A convenience fee is charged for paying with a CreditDebit card. Alisal St 3rd Floor.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. District 4 - Wendy Root Askew. Median Property Taxes Mortgage 3678.

Monterey Co Local Tax Sl 1. Median Property Taxes Mortgage 3678. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

Learn all about Monterey Park real estate tax. Whether you are already a resident or just considering moving to Monterey Park to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Town of Monterey MA.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Single Family Dwelling with GuestGranny Unit and Bath. Clerk of the Board.

California has a 6 sales tax and Monterey County collects an additional 025 so the minimum sales tax rate in Monterey County is 625 not including any city or special district taxes. Total tax rate Property tax. Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-October and payment may be made in two.

Proposition 13 the Peoples Initiative to Limit Property Taxation was passed by California voters in June 1978. Under Proposition 13 the state property tax rate is limited to 1 of the assessed value of the property and increases to the assessed value cannot exceed 2 per year as long as the. You can also get additional insights on median home values.

Multiply the taxable units by the transfer tax. Normally whole-year property taxes are paid upfront a year in advance. Monterey County Tax jurisdiction breakdown for 2022.

This table shows the total sales tax rates for all cities and towns in. Box 308 Monterey MA 01245 Phone. Monterey County Stats for Property Taxes.

Then who pays property taxes at closing when buying a house in Monterey County. Median Property Taxes No Mortgage 2461. Monterey County California sales tax rate.

For assistance in locating your ASMT number contact our office at 831 755-5057. Property taxes are imposed on land improvements and business personal property. Per 1000 Property Value City Rate Revenue.

Identify the full sale price of the property. The median property tax on a 56630000 house is 419062 in California. Monterey County Transfer Tax.

For E-Check a flat fee of 025 is charged. Box 308 Monterey MA 01245 Phone. Monterey County Treasurer - Tax Collectors Office.

Payments may be made to the county tax collector or treasurer instead of the assessor. Post Office Box 390. 110 x 700 770.

700000 1000 700. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Town of Monterey MA.

Monterey County Property Tax Payments Annual Monterey County California. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Monterey County Tax Collector. Identify the full sale price of the property. District 2 - John M.

At the same time responsibility for paying taxes goes with that ownership transfer. Secured property taxes are levied on property as it exists on January 1st at 1201 am.

The California Transfer Tax Who Pays What In Monterey County

Monterey County Home Prices Market Trends Compass

Property Tax By County Property Tax Calculator Rethority

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Additional Property Tax Info Monterey County Ca

The Property Tax Inheritance Exclusion

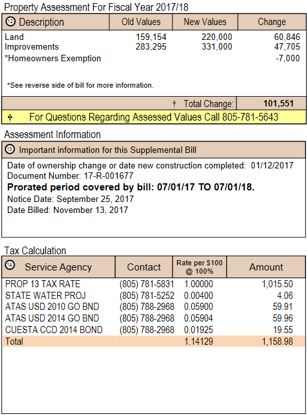

How To Read Your Supplemental Tax Bill County Of San Luis Obispo

Property Tax By County Property Tax Calculator Rethority

At A Glance Monterey County Monterey County Ca

What S In Your Property Tax Bill County Of San Luis Obispo